July 30, 2025

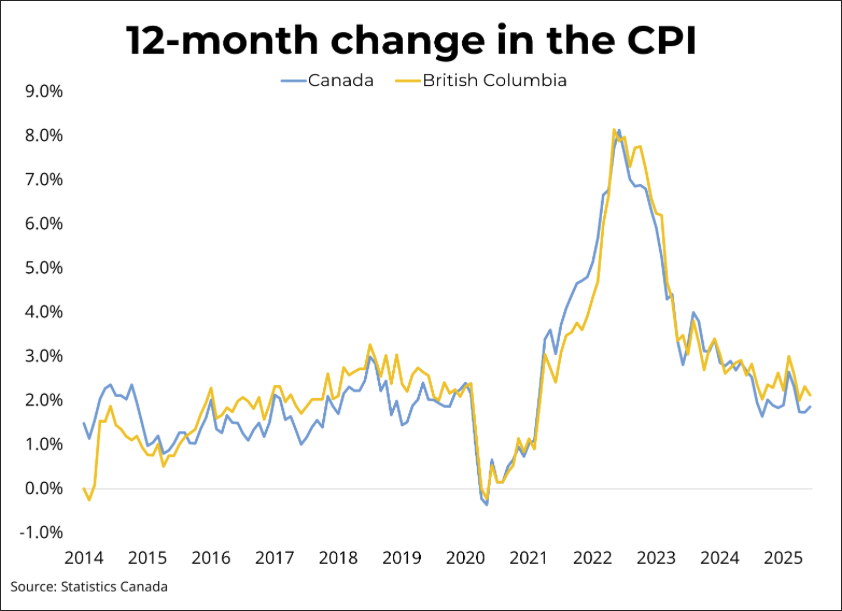

The Bank of Canada held its overnight policy rate at 2.75 per cent this morning. In the statement accompanying the decision, the Bank noted that US tariffs are disrupting trade overall, but the economy is showing some resilience. That said, GDP likely declined by 1.5% in the second quarter as the tariff driven import behaviour by US firms that spurred Canadian exports in the first quarter reversed in the second quarter. Moreover, uncertainty is restraining business and household spending, and labour market conditions are weakening in sectors affected by trade. On inflation, the Bank sees underlying inflation trending around 2.5% but with risks of upward pressure due to tariffs.

Without the added risk of tariff driven inflation, the Bank of Canada would almost certainly be lowering rates in response to a clearly weakening economy that is showing signs of excess supply. However, core inflation continues to trend out of the Bank of Canada's comfort zone on both a 12-month and 3-month basis and the possibility of escalating tariffs is prompting the Bank to be extra cautious. While we expect the Bank will lower rates at its September meeting, that call is at odds with financial markets that are currently pricing in a 2.75% overnight rate for the remainder of the year. Those expectations are being reflected in 5-year bond yields, which have been trending solidly over 3% for the last week which unfortunately will put some upward pressure on 5-year fixed mortgage rates

Disclaimer: Economics Now is produced by the British Columbia Real Estate Association. Real estate boards, real estate associations. Copyright British Columbia Real Estate Association. Reprinted with permission." BCREA makes no guarantees as to the accuracy or completeness of this information.